Liquid is Key

We are over two months into the crisis in Europe. One thing this has pointed out to me, that I remember when I finished school in Ireland in 2009, at the height of the euro-zone crisis. I looked at a brand new petrol station having the pumps taken away, and over the street next to it, a boarded up coffee shop. It doesn't matter the situation, cash is king!

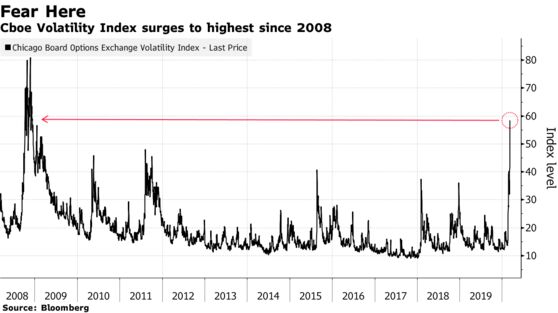

A financial crisis is like a heart attack. It hits the pump

of the economy hard and the organs, as the blood

stops pumping cannot support the body, as they do not have sufficient liquidity. The defibrillator is the central bank, which is the key to getting

trust restored and applying the voltage funding to kick start the heart.

A depression on the other hand, is a much more difficult

patient. Serious organ failure, complimented with underlying health conditions; a

quadruple blowout. There is no clear solution to get this patient out of the

coma. More important, is how the economy is sustained during coma and its

slow recovery; as it is very easy for the large corporates to eat up their

solvent but less liquid competitors.

There are right now, three tiers of balance sheet a business could be.

- Solid cash generation on hand, few illiquid assets i.e. tech companies.

- Easy access to capital markets, with a higher cost of financing due to the demand.

- Cannot access credit and capital impairment probability is high. SMEs and capital-intensive industry.

The final pillar will be the major part of the life support. The ECB and Fed injected over $3 trillion between themselves, with bond buying. However, this is a macro move. Governments have taken their turn in supporting their central banks, but must step in quickly, consistently and effectively, to support the small domestic

economy. Caution should be exercised carefully in the aid to large industry, as it could be throwing Semtex at itself or rattling the sabre of next door neighbours.

Germany is facing serious scrutiny of unfair advantage. As

the EU relaxed its law on state aid due to Covid-19, the German ministry filed

the largest proportion of state-aid claims to the EU, as it helps to prop up big industries, most

notably the airline industry. Though, this has hit hard with less wealthy EU member states left to see their home industries put at a negative advantage.

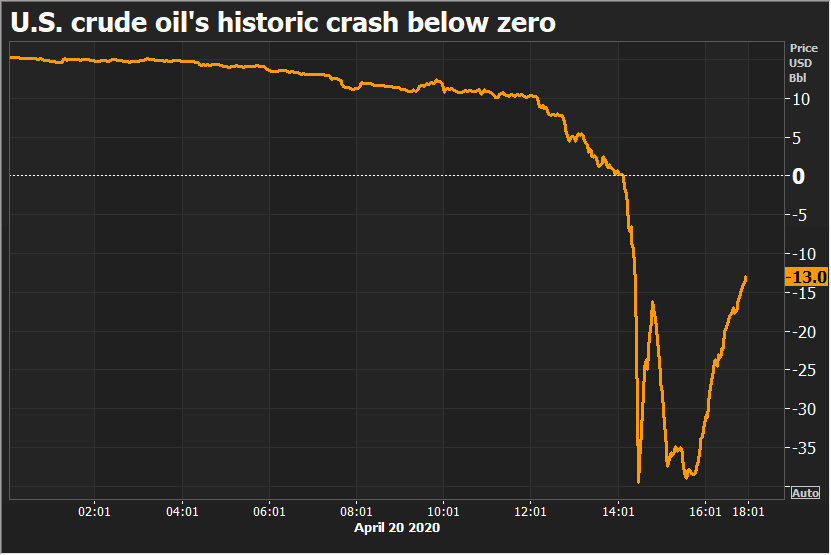

Cheaper than Water

Being a producer of black gold in 2020 will be remembered as

not the best time in the world, being the owner of an empty mine shaft on the other hand.... Oil traders have scoured the globe to find empty Scandinavian salt caves, to unused rail tankers to fill the glutted

supply of unwanted crude.

In late April, Brent fell below zero from the mid-seventies in value of long-ago January, for the first time in history, causing an interesting phenomenon

of a contango. As the spot price fell below zero, future prices overtook in value.

Traders had the unique ability to buy and sell back deliveries on the futures

market at a reasonable profit complimenting an additional surge in storage

demand.

Cheap oil has the incentive of attracting a quicker rebound to

the global economy. However, this comes with its downside when too low. OPEC is seen sometimes as a group of spoilt children, fighting over the lion’s share of

production. But it plays an important stabilisation role of its members

economies. Rural communities in Nigeria are highly dependant on the sale of oil

as a source of income, as are most mid-African and middle eastern nations. However,

with values not expected to go up anytime soon to break-even levels, civil

unrest will be highly probable, even with OPEC cuts.

It would not be a far stretch to think additionally the oil

crash was not intentional. It is well versed the Russian-Saudi annoyance

towards the young shale and fracking industry in the US, which commands a higher

break-even price and is not state supported, thus leaving room to quickly shock the unprotected industry, before slowing the pumps.

Closing remarks with a Gothic upswing

There will be a lot more debt in society, and a stronger desire of companies to look at resilience before efficiency, as a global supply chain can only be efficient if effective.

The rewiring of supply chains away from the inter-dependence of global health will be a major step, already in process. The epidemic in some ways may have triggered an inevitability, as US-China trade tensions from 2019 linger on and the crumbling of the EU collective continues its course.

It would not be a far reaching thought to see a pre Great Depression scenario, whereby the cost of goods and services increases, as well as barriers to entry for international trade, through taxes and tariffs for the protection of home industry. This will deeply stimulate cost push and demand pull inflation. Though, with the technological overview to monitor the economy and global cooperative approaches in the 21st century, it could create a balancing in the distribution of wealth to domestic economies, to the lower income earners. This would occur, as new employment is created locally and low skilled labour is required, leading to social policies winning greater favour in local government institutions, perhaps in the mid-term to incentivise the demand for labour.