As Andrew Bailey warms up to his new office as governor of the Bank

of England, he has a weather pattern that doesn’t sit well. He must wield

the hand of a strained monetary policy in an upcoming Brexit world, and look to

his fellow BoE economists in the impact modelling of Covid-19 on the UK. He knows the effectiveness

of his institution is being tested, and as the rain pours down on thread needle street, the Dow Jones Level - 1 circuit breaker is hit.

Level 1: A drop of 7% from the prior day's closing

price of the S&P 500 triggers a 15-minute trading halt. Trading is not

halted if the drop occurs at or after 3:25 p.m. ET.

Viruses and the economy

A pandemic is an interesting economic scenario, because it

really has an open rule book to how it behaves, depending on the origin. It typically hits supply first, instead of demand. No

matter how high the want for Parmesan cheese may be. A closed factory with a quarantined

workforce in Italy will not meet the consumer demand. Take this with the additional pressure from panic buying, and we have an inverse relationship occurring.

In December, in a small district in the city of Wuhan, China.

A local food market formulated, under the correct conditions Covid-19 that became the kick-starter to the correction of the world economy and largest global pathogenic outbreak in the industrialised world. Covid-19 has

taken advantage of our interdependent infrastructure and supply chain. Bringing

the economic might of China to a halt, and has now spread beyond borders and across the globe. Now with halted production, the dynamic borrowing small & medium enterprises in China depend on are becoming the first economic casualties.

Troubled water for the fishes

March was always going to be a difficult month. Fragile OPEC

talks took place whereby leading oil producing states turned hostile in talks. Already having to deal with an economic slowdown from the virus, led to a terrible

disagreement on supply cuts in order to combat the decline in oil receipts. This combined with negative data ensuing from the previous week, made markets

on the 9th of March hit the circuit breakers on US indices.

What further impact will be felt, is still early days,

however these corrections will turn the portfolio manager to dive deeper into

their folder and see which institutions and corporations are weak on the cash

side and are “zombies” to this economic stagnation.

Airlines usually are the first ones with blood in the water and

will be an interesting case with the crippled airline manufacturing issues from

Boeing. However, they are hit in two ways. A reduction in sales, though also a

reduction in fuel costs as now Jet fuel futures turn cheap. Yet, sales will

take precedent, in combination to employee costs from the Covid-19 impact. March is the main month that fills the balance sheet and with the high ratios of the industry of net debt to Ebitda, the sharks will be circling for the bite.

Passing of the Baton to Fiscal

The last ten years has seen the largest global injection of

cash into financial markets, with central banks fighting the faults of a stalling

global economy. Yet, there are some human elements central bankers cannot solve, and where politicians will have no choice but to step up, as monetary policy

shows its limit.

Government bonds took up the majority of the capital flight as US

and European notes hit historic highs and as the fed made an emergency cut of

50 basis points, the central bankers of the world reaffirmed their position.

Fiscal policy needs to step to the plate.

Despite these warnings for many

years, few economies are willing or able to act. The US congress passed a $8bn emergency corona virus response bill, to help struggling industries, though the euro-zone's export animal Germany needs to act fast, and reduce it's bickering on the purse string to the €1tn budget for the euro-zone. Despite having year-on-year fiscal surpluses Berlin has yet to relieve the several quarters of weak growth to fiscal policy.

Closing remarks

After some further debating, OPEC will reach an agreement after their economies woo on sentiment. Yet, depending on the global fiscal response to small and medium sized industries, the a short lived bear could be an underestimation.

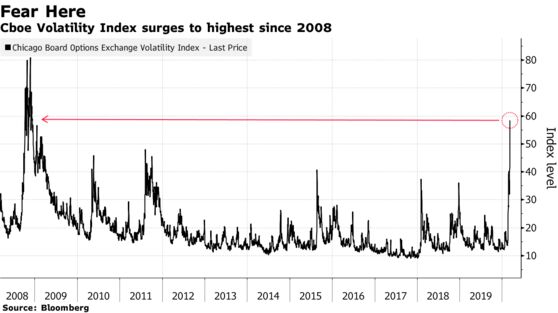

This brings me to my most beloved index. The VIX made it's comeback from the volatility and mania of 2008 on Monday, and acts as a careful reminder to governments and institutions, of the many weak spots the economy still has, if left unbalanced.

No comments:

Post a Comment