So here is my last view of the referendum, I would like to

say that in all of my posts or comments on the Scottish vote, they have all

been taken from an economic & behavioural viewpoint.

The Currency

The UK will not enter a monetary union with Scotland

regardless of the debt levels, due to the fact it gives a major error to the UK

economy’s currency fluctuations. Also the Scottish economy will have to devalue

itself to become competitive. Establish trade agreements which we have no

knowledge of, seeing as Scotland’s requirements for EU membership do not exist

is a big risk, and puts Scotland in unknown territory.

The major issue is that if there is no currency union or even if there was, the deposits of every bank account in Scotland would no longer be guaranteed by the Bank of England.

So we can assume a new currency will be established and will

most likely be a pegged mechanism, that will see a central bank created with its own monetary policy. However this peg will require reserves of more

than 40 Bn GBP, in order to defend any currency attack. If it were to be mature and

stable the Hong Kong equivalent is 135 Bn GBP.

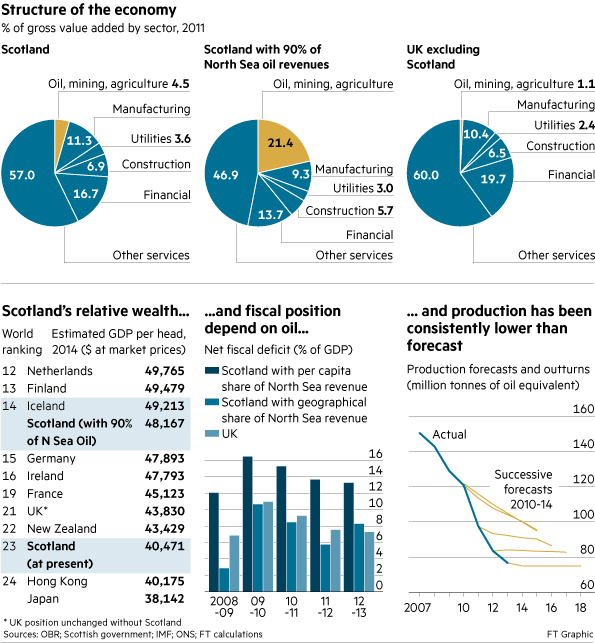

The local economy

For those people who feel Scotland will thrive within 3

years, will be sincerely disappointed and of course the UK will be worse off

without Scotland, because Scotland is bringing down their economy. Which investor in their right

mind desires to keep their assets in an area where uncertainty is

high, and that losses deem to be most certain.

Companies are scaring the Scottish public,and this is for a reason. It is that bad and these companies will be heavily taxed. They may still operate

in Scotland but they will not mind becoming more tax avoidant, as it will cost

less. Thus the Scottish economy will be relying more on income tax. Austerity will have to occur in the first year and the Scottish government would have to go to the money markets, though the money markets are highly unlikely to be friendly in the first 5 years.

Oil & current

world economic cycle

There are a few major issues with the commodities side. Oil

is a great thing, but bear in mind if your currency does not hold large

reserves... If an oil spike were to occur (which many economists will see as

being certain as gravity this winter), Scotland will have serious problems. Especially

as we are about to enter another recessive phase in the growth cycle. I take

this as it can already be seen from slowdowns in Chinese growth.

Chinese Economic

seriousness

China is looking more by every month of turning into a

Japanese economic cycle. The fear behind this is, is that is the debt burden http://time.com/3332552/china-japan-economic-crisis/

. What is more troubling is the heavy value the Bank of China have in US

Treasury Securities which they may sell, even more so now for Geo-Economic

strategy.

The UK Economy

The UK will be a separate country, whose obligations are to

help its own UK citizens and will rightfully do so. However Scotland

will be a foreign country and it will take some time to establish itself as a

working economy, and the UK will have its own problems to think about, due to

the serious loss of assets and investment which will have occurred. Nearly 1

Billion GBP left the economy last week, just due to the referendum.

The Geo political economic world.

From my previous post, the world looks like it is entering the brink again, thus for a new economy to prosper from this is looking rather doubtful.